The explosive growth of Responsible Investing in recent years, compounded by the increased awareness about the negative impacts that economic activities can have on ecosystems and societies, has led to an increased confusion about the terminology used to indicate different "sustainable" activities, indicators, funds and analysis methods.

The importance of increased clarity has been highlighted by a number of actors, including the European Union. In May 2018, the European Commission presented its Action Plan on Sustainable Finance, a package of measures as a follow-up to its action plan on financing sustainable growth. This includes 10 action points, the first proposes a regulation to develop a sustainability 'taxonomy', to provide clarity on which economic activities can be classified as environmentally sustainable. The second Action calls for the development of standards and labels for sustainable finance products, including green bonds, and consideration for SRI fund labelling.

The EU initiative is not the only one focusing on the topic. ISO set up a technical committee in 2018 with scope to look at "Standardization in the field of sustainable finance for the integration of sustainability considerations and environmental, social and governance (ESG) practices into institutional investment decision making and wider finance management". This is separate to ISO 14097, which aims to be the first standard for assessing and reporting investments and financing activities related to climate change, due to launch in 2019.

More recently, the Investment Association announced the launch of a consultation on the classification of environmental, social and governance funds. The work is to include an investigation of whether the UK needs a different definition than the one used on the continent, due to the evolution of the market over the last decade, and whether ESG funds need labels, or demonstrate how ESG heavy/light they are.

The Climate Bonds Initiative is an international group working on a labelling system for bonds, which includes a taxonomy - "a tool for issuers, investors, governments and municipalities to help them understand what the key investments are that will deliver a low carbon economy".

The mushrooming of initiatives currently taking place shows the importance of the subject, but also the confusion that reigns among the different actors in the financial industry. Moreover, the issue is crucial to investors, to ensure that when they select, or are recommended, an investment they receive what they expect (in terms of outcomes and the types of companies they are invested in).

Definitions

Existing definitions of relevant terms also abound, and the following gives an overview of some key terms, from some key organisations:

According to the United Nations Principles for Responsible Investment (UN-PRI) "responsible investment is an approach to investing that aims to incorporate environmental, social and governance (ESG) factors into investment decisions, to better manage risk and generate sustainable, long-term returns." The UN-PRI itself specifies that "responsible investment does not require ruling investment in any sector or company. It simply involves including ESG information in investment decision-making, to ensure that all relevant factors are accounted for when assessing risk and return".

Similarly, according to the group Swiss Sustainable Finance "Sustainable finance refers to any form of financial service integrating environmental, social and governance (ESG) criteria into the business or investment decisions for the lasting benefit of both clients and society at large"

The UK Sustainable Investment and Finance Association (UKSIF) states that "Sustainable investment and finance incorporates environmental, social and governance factors in financial services decision-making alongside more traditional financial criteria" but adds that "sustainable investment and finance may sometimes be described as 'green', 'ethical', 'responsible', 'sustainable and responsible' and/or 'ESG'. UKSIF uses these terms to describe use of any sustainable and responsible investment and finance approach, although others may sometimes use them in narrower ways."

At the same time, Greenchip Investments suggested that the terms 'Responsible' and 'Sustainable' investing can be considered synonyms, while acknowledging the confusion that reigns over the meaning of acronyms such as ESG, SRI (Socially Responsible Investing), MRI (Mission Responsible Investing) and RI (Responsible Investing).

Ethical

According to the website Investopedia "Ethical investing refers to the practice of using one's ethical principles as the primary filter for the selection of securities investing. Ethical investing depends on an investor's views." This expression of the investor's views leads to what is generally known as 'negative screening', meaning the exclusion from the investible universe of a number of stocks that do not correspond with the criteria set forth by the investor.

Historically, negative screening has focused on a specific number of areas of exclusion, usually referred to as the 'sextet of sin': alcohol, gambling, tobacco, armaments, pornography and nuclear power. Norms based screening is a sub-set of this approach, using breaches of international standards, and globally accepted programmes to avoid investing in certain companies.

It has been observed that "excluding companies until they start to behave responsibly is much more than naming and shaming. It's an invitation and a request for them to start reflecting on their activities and the negative impact they may have on our society and the environment in the long-term". We concur with this view, also with regards to the indirect effects of campaigns such as divestment from fossil fuels. Indeed, it has been demonstrated that, while the direct impacts may be limited, "the indirect impacts, in terms of public discourse shift, are significant". Divestment related to fossil fuels in particular has put on the agenda the link between finance and climate change, changed the political discourse around topics such as directors' fiduciary duty, and empowered and revitalised stakeholders such as the environmental movement.

ESG

The consideration of Environment, Social and Governance factors to guide investment choices is arguably the fastest-growing trend in the world of responsible investment, and it is not hard to understand why. After all, many studies have proven that, in the least, there are no negative effects on returns. Indeed, research has successfully argued that there is a statistical link between a company's track record on social issues and positive returns to shareholders.

What is commonly referred to as 'ESG investing' can be broken down into a number of sub-strategies. These include:

- ESG Integration, that the UN-PRI defines as "the explicit and systematic inclusion of ESG issues in investment analysis and investment decisions. Put another way, ESG integration is the analysis of all material factors in investment analysis and investment decisions, including environmental, social, and governance (ESG) factors."

- Best in Class ESG Investment, which can be seen as an evolution of ESG integration, refers to the composition of portfolios by the active selection of only those companies that meet a defined ranking hurdle established by environmental, social and governance criteria.

- Engagement and Voting, "a long-term process, seeking to influence behaviour or increase disclosure". with regards to ESG matters. This approach recognises that investors have the power to change corporate behaviour through a continuous collaboration (and in some cases confrontation) with company management on ESG issues.

Sustainable

Perhaps the most broadly used term, sustainable investing is commonly used as a descriptor for all the above strategies. It is also used interchangeably with responsible investment as a general term, as outlined above.

There is, however, a widely accepted definition of Sustainable Development, from the 1992 report of the World Commission on Environment and Development: Our Common Future (more commonly known as Brundtland Report), which defines Sustainable Development as "development that meets the needs of the present without compromising the ability of future generations to meet their own needs." This leads to the argument that 'Sustainable Investing' should be more closely aligned to concepts such as 'Thematic' and 'Impact Investment', as these are focused on more inherently positive products and services, particularly if these can be aligned with the UN Sustainable Development Goals.

Thematic investing targets companies that fit a certain niche or industry activity, and there are an increasing number of sustainable options, for example, clean energy, natural resource scarcity, and low-carbon/climate change.

Impact investing is a targeted approach, that aims to achieve a measurable positive social or environmental outcome, alongside a financial return.

Need for Clarity

While these strategies show the potential of responsible investment to satisfy investor needs, the approaches are not without risks. Indeed, numerous actors have highlighted one major flaw in the use of ESG ratings (or sustainability ratings, as Morningstar calls them) - the fact that such ratings tend to favour larger companies that have the scale to produce the data necessary to score highly. This problem can probably be traced back to the conception of ESG integration as a risk management strategy. This means that companies are rewarded if they offset the risks that their activities create. This can, paradoxically, be easier for companies with bigger impacts - the more negative things there are, the more positive steps can be taken to mitigate them. Simple measures on a large scale can also have more resounding effects than the same measures applied to small-scale operations.

Take the example of an oil company: it can have a very high ESG score because, due to the inherent risks connected to its operations, its management systems are usually very well developed. However, the company's operations cannot be considered sustainable in the sense of the Brundtland report. To follow this example through, Royal Dutch Shell's inclusion in the Dow Jones Sustainability Index is, we argue, an example of confusion in terminology - it may be a reasonably well managed oil company that scores well on an ESG assessment, but is in no-way an example of a truly sustainable company. Does its inclusion meet a client's expectation of a sustainable investment? Similarly, British American Tobacco tends to score highly on ESG ratings assessments, but its inclusion in a 'sustainable' fund would raise eyebrows amongst the majority of our clients.

Taxonomy

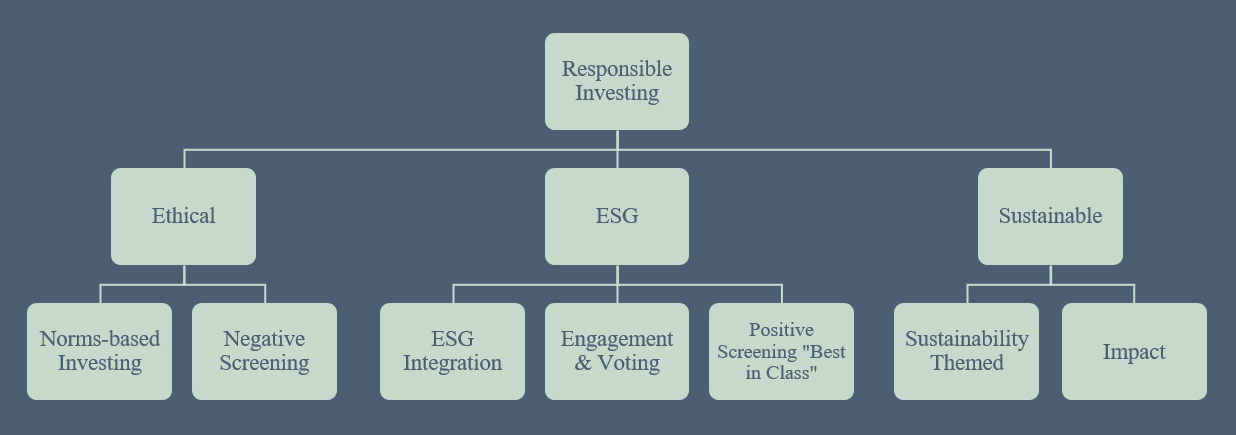

After a careful analysis of the sometimes-contrasting views around the industry, we believe that a summary of the current approaches could be explained through the following scheme:

Conclusions

A key element when applying a responsible investment strategy, is to explain to the investor the nature of that strategy - is it a sustainable fund based around the concept of an ESG rating, or does it select impact stocks that fulfil positive themes? These are very different approaches that may both be labelled sustainable.

The strategies are also not mutually exclusive: ethical exclusions can, and in some cases should, be included in an impact/thematic investing strategy (a portfolio aimed at increasing Health and Well-being which doesn't exclude Tobacco companies would hardly be effective). However, creating a taxonomy is necessary to avoid misattribution of 'sustainable' characteristics to investment strategies that do not focus on sustainability.

Indeed, our view is that a complete and reliable sustainable investment strategy should use a mix of approaches. A first 'negative screen' to exclude stocks on ethical grounds, should be followed by an analysis of the companies' ESG performance, to select those that provide the best long-term outlook. Lastly, a third 'sustainability' analysis could be applied, to make sure that the investment will not only avoid negative impacts, but also have a positive impact on the state of the world.

As the mainstreaming of responsible investment continues, strongly guided by the widespread acceptance of ESG as an investing tool, it is essential that the various initiatives currently developing find a way to act in synergy with one another. Continuing confusion over taxonomy for different strategies will create increased misunderstanding amongst investors, increase the likelihood of 'greenwashing' thereby devaluing the concept, and squandering the potential of truly sustainable investment to benefit positively the environment and society.